In 2018, the Institute of Development Studies partnered with the Open Society Foundations Economic Justice Programme to build an evidence base to explore the question: “What constitutes meaningful participation in economic advancement?” Researchers sought to map cases in which alternative economic processes allow people at the grassroots level to have a real voice in economic decision-making, including business and financing models that enable participation.

One such model highlighted through a case study is the Buen Vivir Fund, a pioneer in the field of impact investment, founded by the non-profit organization Thousand Currents. Generally, impact investors seek to generate social and environmental impacts in addition to generating a profit from their investments. With assets clocking in at over 200 billion dollars, impact investment harbors a lot of potential to shake up mainstream investment and international development.

However, the impact investment process itself is decidedly still ‘business as usual’: dominated by investors, who seek little if any input from the people the investments claim to benefit. Which makes the business dealings at the Buen Vivir Fund quite unusual.

The Buen Vivir Fund is based on the concept of buen vivir, or ‘right living’, a term that denotes a way of living that is in balance with the natural world and community, originating from indigenous peoples in Latin America.

The Buen Vivir Fund employs an innovative, participatory investment approach where investors and grass-roots representatives have equal representation and voting rights in the governance and management of the Fund through its governing authority, the Members Assembly.

Currently there are 18 individuals in the Members Assembly: 10 representatives from grassroots organisations, some of whom are elected to the position by their organisations’ constituents, and 8 institutional investors.

Through another participatory investment approach deployed, instead of fixed interest payments, a solidarity contribution (referred to as an aporte) is made on top of the repayment of the principal loan. The amounts of these aporte payments are self-determined by grassroots organisations and are made during or upon completion of successful projects.

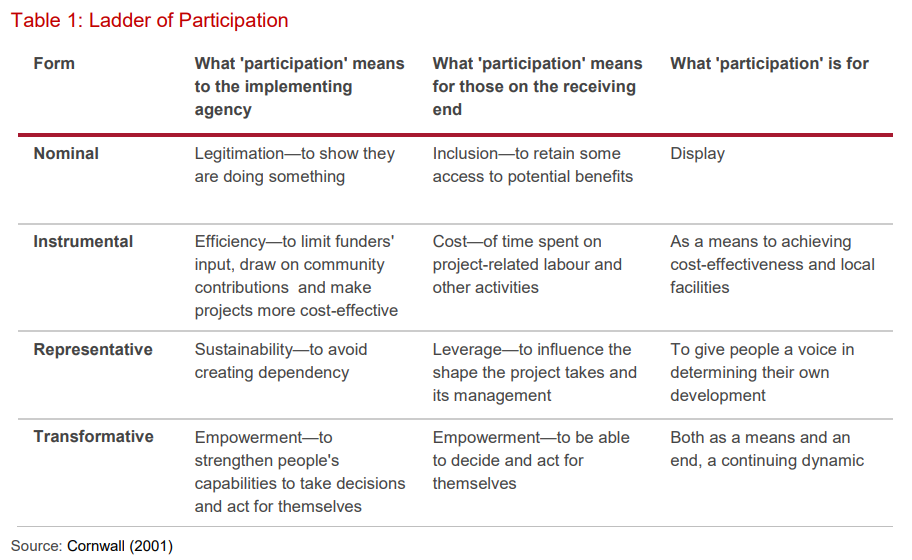

According to its former director, Joanna Levitt Cea, the Buen Vivir Fund chose to maintain a commitment to start small, raising 1 million USD in loan capital for its initial investment cycle, and growing incrementally in order to make membership in the Fund ‘a transformational experience for all and not a transactional one’. Indeed, scholars often place a participatory practice on a ladder that illustrates the progression of participatory processes from nominal to transformative.

According to this scale, for a participatory approach to be transformative it must ‘strengthen people’s capabilities to take decisions and act for themselves.’ This is precisely what the Members Assembly and aporte payments allow: direct and deep participation in economic decision-making by ordinary people.

Demonstrating the unique value being offered to the impact investment space, the Buen Vivir Fund currently has a waiting list and will be opening to new members in 2020. The Fund is poised to increase its investments to 5 million USD over the next five years. The current Members Assembly will determine a path for expansion that will retain the relational and participatory nature of the Fund.

In the words of Don Javier Inda, a co-founder of EduPaz, a Buen Vivir Fund investee organisation that supports indigenous and peasant farming communities in Mexico by deploying loan capital to seed the work of rural producers to create small enterprises: “Our main role is to accompany and advise in the journey of the groups with whom we work. It is [a] process of popular education: a shared and reflective practice among the participants; learning together in the process itself and walking together; supported by the collective wisdom of indigenous and peasant cultures; and a bet on their creativity and resilience.”

Learn more about the Buen Vivir Fund in the full IDS case study.